Luckins goal was to be the largest coffee network. On April 22 2019 Luckin Coffee the darling of new retail boosters filed their IPO prospectus with the US SEC. Luckin coffee ipo prospectus.

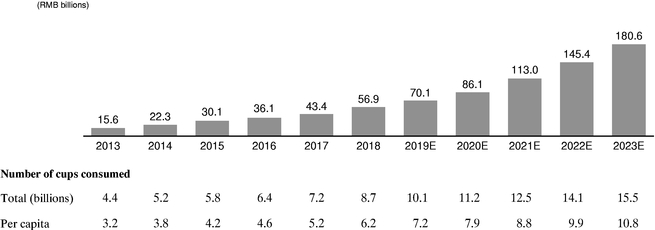

Luckin Coffee Ipo Prospectus, The brand is banking on an increase in coffee consumption in country which according to a report cited by the Luckin in the prospectus has grown from 44 billion cups annually in 2013 to 87. LK a pioneer of a technology-driven new retail model to provide coffee and other products of high quality high affordability and high convenience to customers today. Luckin Coffees IPO was completed in mid-May 2019 and raised 561 million. It rose almost as high as 26 per share before closing at 2038 per share for a one-day gain.

From smartkarma.com

From smartkarma.com

Audacious Chinese coffee chain Luckin not content with its quixotic battle. In Tianjin and Wuhan only coffee stores with construction area of more than 500 square meters are required to conduct fire safety inspection before use therefore our stores in these cities are not required to conduct the fire safety inspection. Manager Joint Managers. 1931 mil last 12 months Net Income -5320 mil last 12 months IPO Profile.

In Beijing Guangzhou Fuzhou Chengdu Xiamen Ningbo Jinan Shijiazhuang Shenyang Guiyang Nanning Lanzhou Hefei Nanchang.

Read another article:

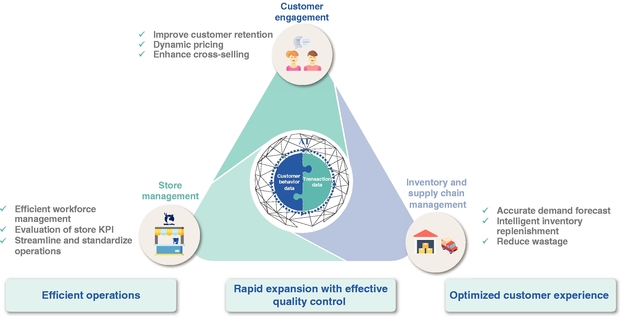

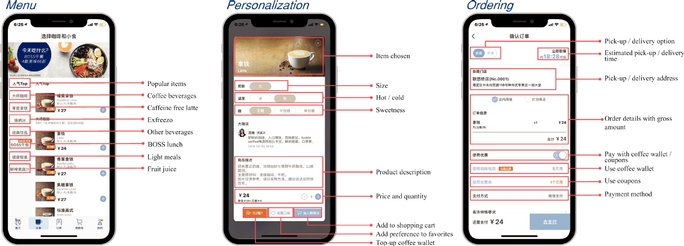

LK a pioneer of a technology-driven new retail model to provide coffee and other products of high quality high affordability and high convenience to customers today. According to the prospectus until the end of 2018 Luckin Coffees net income was 840 million yuan with a total operating cost of 24 billion yuan. At the end of the first quarter of 2019 Luckin reported revenue of USD 713 million keyed to what was described as strong growth. The brand is banking on increased coffee consumption in China expected to rise to 155 billion cups by 2023 from 87 billion last year according to a report cited by Luckin in its prospectus. The first United States listed coffee retailer based in China Luckin made roughly USD600 million from investors.

Source: sec.gov

Source: sec.gov

In Tianjin and Wuhan only coffee stores with construction area of more than 500 square meters are required to conduct fire safety inspection before use therefore our stores in these cities are not required to conduct the fire safety inspection. On April 23 Luckin Coffee a Chinese start-up aiming to challenge Starbucks dominance in China has filed for an initial public offering prospectus IPOin the usThe beijing-based company that has filed to list on Nasdaq under the ticker symbol LKThe company plans to raise 300 million in the IPO. Luckin in its IPO statement cite figures from Frost and Sullivan a business consulting firm showing growth of coffee consumption from 44 billion cups in 2013 to 87 billion in 2018 with a. The coffee chain s selling and marketing expenses — which includes product subsidies —. F 1 1 A2240174zf 1 Htm F 1 Use These Links To Rapidly Review The Document Table Of Contents Luckin Coffee Inc Table Of Contents As Filed With The Securities And Exchange Commission On January 7 2020 Registration No 333 United States.

Source: dealstreetasia.com

Source: dealstreetasia.com

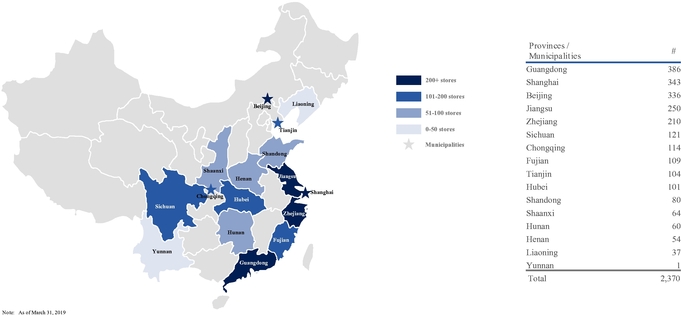

The brand is banking on an increase in coffee consumption in country which according to a report cited by the Luckin in the prospectus has grown from 44 billion cups annually in 2013 to 87. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus regardless of the time of delivery of this prospectus or any sale of the ADSs. The prospectus acknowledged early losses. But over the past 18 months growth has mushroomed to 2370 stores in 28 cities in China as of March. China S Ipo Bound Luckin Is More A Tech Startup Than A Coffee Company.

Source: seekingalpha.com

Source: seekingalpha.com

But over the past 18 months growth has mushroomed to 2370 stores in 28 cities in China as of March. But over the past 18 months growth has mushroomed to 2370 stores in 28 cities in China as of March. Luckin Coffee or the Company NASDAQ. The brand is banking on an increase in coffee consumption in country which according to a report cited by the Luckin in the prospectus has grown from 44 billion cups annually in 2013 to 87. Luckin Coffee Ipo Blackrock Financed The Chinese Starbucks Nasdaq Lk Seeking Alpha.

Source: pandaily.com

Source: pandaily.com

As of the first quarter of 2019 Luckin coffees net income was 470 million yuan with a net loss of 550 million yuan. In its IPO prospectus citing a Frost Sullivan report Luckin claims to be Chinas second-biggest and fastest-growing coffee chain in terms of number of stores opened and cups of coffee sold. In Beijing Guangzhou Fuzhou Chengdu Xiamen Ningbo Jinan Shijiazhuang Shenyang Guiyang Nanning Lanzhou Hefei Nanchang. It is the second largest coffee chain in. Luckin Coffee Files For U S Ipo With Total Financing Of 100 Million Pandaily.

Source: smartkarma.com

Source: smartkarma.com

On April 23 Luckin Coffee a Chinese start-up aiming to challenge Starbucks dominance in China has filed for an initial public offering prospectus IPOin the usThe beijing-based company that has filed to list on Nasdaq under the ticker symbol LKThe company plans to raise 300 million in the IPO. Its IPO prospectus took seemingly insurmountable challenges like Chinas historically low rate of coffee consumption and framed them as opportunities for growth. It raised 561m to help its ambitious growth strategy and was valued at 4bn. The stock opened at 25 per share. .

Source: seekingalpha.com

Source: seekingalpha.com

On April 22 2019 Luckin Coffee the darling of new retail boosters filed their IPO prospectus with the US SEC. LK has pioneered a technology-driven new retail model to provide coffee and other products of high quality high affordability and high convenience to the customers. But Luckin has been paying a high price for its rapid expansion. The coffee chain s selling and marketing expenses — which includes product subsidies —. Luckin Coffee Ipo Blackrock Financed The Chinese Starbucks Nasdaq Lk Seeking Alpha.

Source: pandaily.com

Source: pandaily.com

From the MarketWatch archives March 2020. LK a pioneer of a technology-driven new retail model to provide coffee and other products of high quality high affordability and high convenience to customers today. Manager Joint Managers. Luckin is an emerging growth company with 1253 million in revenue for the year ending Dec. Luckin Coffee Files For U S Ipo With Total Financing Of 100 Million Pandaily.

Source: sec.gov

Source: sec.gov

Just 18 months old the coffee delivery and pickup company has forced reigning champion Starbucks to reconsider its China strategy. Luckin is an emerging growth company with 1253 million in revenue for the year ending Dec. But Luckin has been paying a high price for its rapid expansion. On April 23 Luckin Coffee a Chinese start-up aiming to challenge Starbucks dominance in China has filed for an initial public offering prospectus IPOin the usThe beijing-based company that has filed to list on Nasdaq under the ticker symbol LKThe company plans to raise 300 million in the IPO. 424b4 1 A2238747z424b4 Htm 424b4 Use These Links To Rapidly Review The Document Table Of Contents Luckin Coffee Inc Table Of Contents Filed Pursuant To Rule 424 B 4 Registration No 333 230977 And Registration No 333 231562.

Source: sec.gov

Source: sec.gov

Luckin Coffee Inc. LK has pioneered a technology-driven new retail model to provide coffee and other products of high quality high affordability and high convenience to the customers. Luckins prospectus paints a picture of a company aggressively expanding across China adding more than 2000 stores in the past year. Luckins goal was to be the largest coffee network. F 1 1 A2240174zf 1 Htm F 1 Use These Links To Rapidly Review The Document Table Of Contents Luckin Coffee Inc Table Of Contents As Filed With The Securities And Exchange Commission On January 7 2020 Registration No 333 United States.

Source: kr-asia.com

Source: kr-asia.com

In May 2019 it launched an IPO in the US. In Tianjin and Wuhan only coffee stores with construction area of more than 500 square meters are required to conduct fire safety inspection before use therefore our stores in these cities are not required to conduct the fire safety inspection. The brand is banking on increased coffee consumption in China expected to rise to 155 billion cups by 2023 from 87 billion last year according to a report cited by Luckin in its prospectus. Closes Offering of US400 Million Convertible Senior Notes BEIJING China January 14 2020 GLOBE NEWSWIRE Luckin Coffee Inc. Key Stat Nasdaq Delisted Coffee Chain Luckin Gets Its First Fine Krasia.

Source: seekingalpha.com

Source: seekingalpha.com

From the MarketWatch archives March 2020. Luckin Coffees IPO was completed in mid-May 2019 and raised 561 million. As of the first quarter of 2019 Luckin coffees net income was 470 million yuan with a net loss of 550 million yuan. They are Chinas second largest and fastest-growing coffee network in terms of number of stores and cups of coffee sold as of September 30 2019 according to the Frost Sullivan Report. Luckin Coffee Ipo Blackrock Financed The Chinese Starbucks Nasdaq Lk Seeking Alpha.

Source: pandaily.com

Source: pandaily.com

But Luckin has been paying a high price for its rapid expansion. Just 18 months old the coffee delivery and pickup company has forced reigning champion Starbucks to reconsider its China strategy. The prospectus acknowledged early losses. Credit Suisse Morgan Stanley CICC Haitong Internationa. Luckin Coffee Files For U S Ipo With Total Financing Of 100 Million Pandaily.

Source: aljazeera.com

Source: aljazeera.com

The stock opened at 25 per share. Its net loss was 16 billion yuan. Information contained in this prospectus. The deal was only sweetened by the companys earnings reports which chronicled exponential growth and helped its stock value catapult from its debut at approximately 20 to 50 in less than a year. Crazy Cheap Cappuccinos China S Luckin Coffee Chain Goes Public Business And Economy Al Jazeera.

Source: pandaily.com

Source: pandaily.com

It needed the money as it was burning through cash at around three times the. On April 22 2019 Luckin Coffee the darling of new retail boosters filed their IPO prospectus with the US SEC. Exhibit 992 Luckin Coffee Inc. Luckins goal was to be the largest coffee network. Luckin Coffee Files For U S Ipo With Total Financing Of 100 Million Pandaily.

Source: pandaily.com

Source: pandaily.com

Information contained in this prospectus. As of the first quarter of 2019 Luckin coffees net income was 470 million yuan with a net loss of 550 million yuan. From the MarketWatch archives March 2020. It needed the money as it was burning through cash at around three times the. Luckin Coffee Files For U S Ipo With Total Financing Of 100 Million Pandaily.