RepRisk categorizes Luckin Coffee as very high risk Peak RRI 73 in April 2020. Luckin Coffee will unluckinly delist from Nasdaq following fraud allegations It was one of the fastest-growing startups in modern history and one of the most anticipated IPOs of 2019. Luckin coffee fraud report.

Luckin Coffee Fraud Report, Since all orders are placed through its. Luckin Coffee once a respected profitable company has been caught up in financial statement. The company has built an independent special committee to conduct the investigation. This is further reinforced by Chinas refusal to grant access for foreign accounting oversight boards to the financial and accounting documents of firms such denial is attributed to Chinas state.

Pin On Business From pinterest.com

Pin On Business From pinterest.com

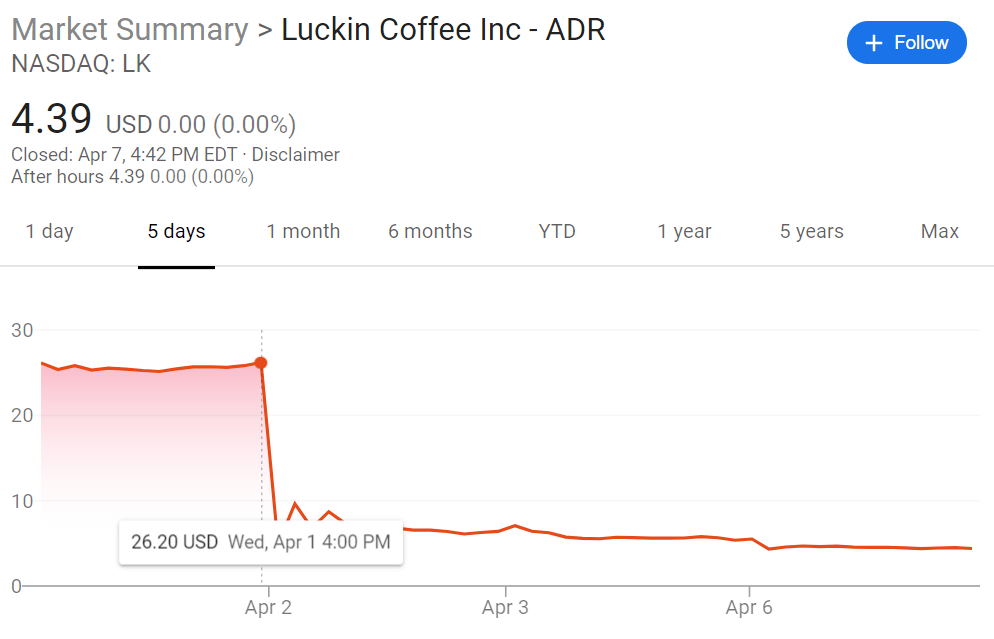

As shares of the company plunged by as much as 75 in a single day of trading the Chinese internet wrote it off with a snarky epitaph. Forensic Accounting Acnt620 Luckin Coffee Financial Reporting Investi gation. Luckin Coffee suspends COO and other staff members announces internal investigation into possible financial fraud and warns investors to disregard previous financial statements. Luckin Coffee once a respected profitable company has been caught up in financial statement.

Luckin was bound to go under.

Read another article:

Luckin Coffee will unluckinly delist from Nasdaq following fraud allegations It was one of the fastest-growing startups in modern history and one of the most anticipated IPOs of 2019. The Accounting Scandal and Fraud at Luckin Coffee Luckin made false statements and fabricated its financial performance to lure in investors. Luckin Coffee once a respected profitable company has been caught up in financial statement. What does one take away from Luckins story especially if you are an investor or an aspiring investor. The night of april 2 2020 luckinoffee released an internal investigation report on c fake 22 billion yuan transactions after the investigation admitting that jian liu the companys chief operating officer and director and his employees engaged in improper behaviors including falsifying transaction data starting from the second quarter.

Source: accountancydaily.co

Source: accountancydaily.co

In an effort t o beat out their competitors and maintain astonishing performance Luckin. But it disclosed this April that its chief operating officer fabricated the companys 2019 sales by about 22 billion yuan 310 million. Luckin Coffee suspends COO and other staff members announces internal investigation into possible financial fraud and warns investors to disregard previous financial statements. And within 2 months of the report becoming public the company admitted the fraud Luckins stock price tanked 80 and the companys very existence is now under threat. China S Luckin Coffee Fined 180m For Accounting Fraud Accountancy Daily.

Source: pandaily.com

Source: pandaily.com

NEW YORK Oct 26 Reuters - Luckin Coffee Inc LC0AyMU reached a 175 million settlement of shareholder class-action claims that the Chinese rival to Starbucks fraudulently inflated its share. Luckin was bound to go under. By the time the Muddy Waters report came out the companys stock well American Depositary Receipt ADR had skyrocketed from the IPO price of 17 a share in May 2019. The report claimed that Luckin was inflating the number of items sold per day by 69 in the third quarter of 2019 and 88 in the fourth. Luckin Coffee Reaches Preliminary Agreement Worth 175 Million For Class Action Settlement Pandaily.

Source: pandaily.com

Source: pandaily.com

Luckin failed to disclose accurate revenue and expenses and also obtained money through false bank statements. Luckin Coffee Financial Reporting Investigation. It sounds outrageous. As shares of the company plunged by as much as 75 in a single day of trading the Chinese internet wrote it off with a snarky epitaph. Stained By Fraud Scandal Luckin Coffee Is Seeking A Path Out Pandaily.

Source: pinterest.com

Source: pinterest.com

The fraud began in April 2019 a. Companys share price drops to USD 640. It sounds outrageous. With defrauding investors by materially misstating the companys revenue expenses and net operating loss in an effort to falsely appear to achieve rapid growth and increased profitability and to meet the companys earnings estimates. Pin On Business.

Source: thetechee.com

Source: thetechee.com

Luckin Coffee as one of the most successful marketing cases in China or even the world break the fastest IPO record in China in 2019. This is further reinforced by Chinas refusal to grant access for foreign accounting oversight boards to the financial and accounting documents of firms such denial is attributed to Chinas state. As shares of the company plunged by as much as 75 in a single day of trading the Chinese internet wrote it off with a snarky epitaph. When Luckin Coffee NASDAQ. China S Luckin Coffee Gets 250m Investment After Fraud Fallout The Techee.

Source: livenewsclub.com

Source: livenewsclub.com

However the recent fraud has led to the great attention fear of the reliability and value of Chinese stock market. Luckin failed to disclose accurate revenue and expenses and also obtained money through false bank statements. And within 2 months of the report becoming public the company admitted the fraud Luckins stock price tanked 80 and the companys very existence is now under threat. But it disclosed this April that its chief operating officer fabricated the companys 2019 sales by about 22 billion yuan 310 million. Starbucks Chinese Rival Luckin Coffee Files For Bankruptcy In The Us.

Source: kr-asia.com

Source: kr-asia.com

The affected transactions were reported between Q2 2019 and Q4 2019. Luckin Coffee will unluckinly delist from Nasdaq following fraud allegations It was one of the fastest-growing startups in modern history and one of the most anticipated IPOs of 2019. The company has built an independent special committee to conduct the investigation. April 2020 - Luckin said on April 2 that an internal investigation had shown its. Luckin Confirms Inflated Revenues For Usd 300 Million Amid Board Factionalism Krasia.

Source: yicaiglobal.com

Source: yicaiglobal.com

It sounds outrageous. The chief operating officer of Luckin Coffee the largest domestic coffee chain in the China was accused by his own company of fabricating much of its reported sales in 2019. In an effort t o beat out their competitors and maintain astonishing performance Luckin. April 5 Luckin Coffee share price decreases. China S Luckin Coffee Denies Plans For New Round Of Fundraising.

But it disclosed this April that its chief operating officer fabricated the companys 2019 sales by about 22 billion yuan 310 million. Forensic Accounting Acnt620 Luckin Coffee Financial Reporting Investi gation. The night of april 2 2020 luckinoffee released an internal investigation report on c fake 22 billion yuan transactions after the investigation admitting that jian liu the companys chief operating officer and director and his employees engaged in improper behaviors including falsifying transaction data starting from the second quarter. One year after being delisted from the Nasdaq following an accounting scandal tarnished Chinese coffee chain Luckin Coffee on June 30 published a restated 2019 financial statement its first financial report since the company admitted to fabricating transactions in April 2020. Luckin Coffee Fabricated 310 Million In Sales Investigation.

Source: comunicaffe.com

Source: comunicaffe.com

Chinese beverage chain Luckin coffee shares plummeted 756 on Thursday after it disclosed that several employees including its COO had fabricated transactions for much of 2019 amounting to an estimated RMB 22 billion in falsified sales. Luckin Coffee a Starbucks imitator. But it disclosed this April that its chief operating officer fabricated the companys 2019 sales by about 22 billion yuan 310 million. So that leaves us with one final question. Kyros Law Announces Plans To File Legal Claims On Behalf Of Luckin Coffee.

Source: yicaiglobal.com

Source: yicaiglobal.com

Luckin Coffee as one of the most successful marketing cases in China or even the world break the fastest IPO record in China in 2019. As shares of the company plunged by as much as 75 in a single day of trading the Chinese internet wrote it off with a snarky epitaph. In the statement Luckin confirmed for the first time that it inflated its annual costs and. Luckin Coffee a Starbucks imitator. Luckin Coffee Gains After Reaching Usd187 Million Settlement With Investors.

Source: timesofmalta.com

Source: timesofmalta.com

And within 2 months of the report becoming public the company admitted the fraud Luckins stock price tanked 80 and the companys very existence is now under threat. This paper analyzes the fraud of Luckin Coffee faking process and the general publics. The company has built an independent special committee to conduct the investigation. April 2020 - Luckin said on April 2 that an internal investigation had shown its. Us Fines China S Luckin Coffee 180m In Fraud Probe.

Source: medium.com

Source: medium.com

Luckin Coffee a Starbucks imitator. Luckin Coffee as one of the most successful marketing cases in China or even the world break the fastest IPO record in China in 2019. Since all orders are placed through its. The fraud began in April 2019 a. Not So Lucky Luckin Coffee A Telltale Sign Of The Fastest Growing By Jeffrey Dong The Startup Medium.

Source: chinadaily.com.cn

Source: chinadaily.com.cn

Since all orders are placed through its. With defrauding investors by materially misstating the companys revenue expenses and net operating loss in an effort to falsely appear to achieve rapid growth and increased profitability and to meet the companys earnings estimates. This is further reinforced by Chinas refusal to grant access for foreign accounting oversight boards to the financial and accounting documents of firms such denial is attributed to Chinas state. The night of april 2 2020 luckinoffee released an internal investigation report on c fake 22 billion yuan transactions after the investigation admitting that jian liu the companys chief operating officer and director and his employees engaged in improper behaviors including falsifying transaction data starting from the second quarter. Luckin Coffee Shares Down 75 After Fraud Revelations Chinadaily Com Cn.

Source: bartalks.net

Source: bartalks.net

In the statement Luckin confirmed for the first time that it inflated its annual costs and. By the time the Muddy Waters report came out the companys stock well American Depositary Receipt ADR had skyrocketed from the IPO price of 17 a share in May 2019. So that leaves us with one final question. 2020 of massive fraud at the company perpetrated at the highest levels. Luckin Coffee Received Delisting Notice.