Company Profile The first store in Luckin coffee opened in October 2017 and Luckin coffee was listed on NASDAQ on May 17 2019. The Accounting Scandal and Fraud at Luckin Coffee Luckin made false statements and fabricated its financial performance to lure in investors. Luckin coffee fraud case.

Luckin Coffee Fraud Case, Company Profile The first store in Luckin coffee opened in October 2017 and Luckin coffee was listed on NASDAQ on May 17 2019. Luckin Coffee is Chinas new retail specialty coffee operator known as a cost effective conscientious enterprise founded in 2017 by Zhiya Qian. These were some of the claims that inspired investors to believe that they could take on a company such as Starbucks on a global scale. Chinas Luckin Coffee has agreed to pay a 180 million penalty to settle accounting fraud charges the Securities and Exchange Commission says.

Luckin Coffee Accused Of Fraud Key Facts So Far Thestreet From thestreet.com

Luckin Coffee Accused Of Fraud Key Facts So Far Thestreet From thestreet.com

Chinas Luckin Coffee has agreed to pay a 180 million penalty to settle accounting fraud charges the Securities and Exchange Commission says. The fraud emerged during an annual external audit for the Luckins financial statements. Company Profile The first store in Luckin coffee opened in October 2017 and Luckin coffee was listed on NASDAQ on May 17 2019. Chinas Luckin Coffee to pay 180 million fine in fraud case The US.

Chinas Luckin Coffee has agreed to pay a 180 million penalty to settle accounting fraud charges the Securities and Exchange Commission says.

Read another article:

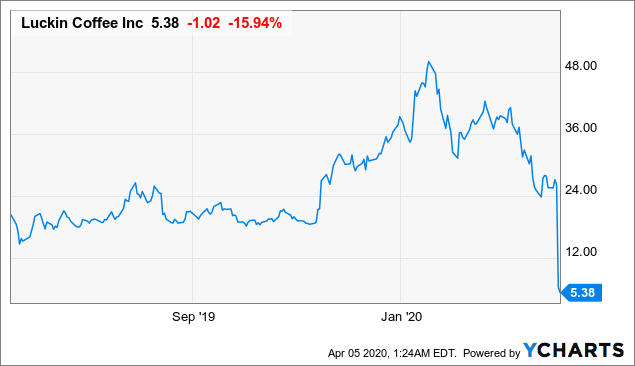

Some venture capitalists lost interest after they sampled what the company Luckin Coffee Inc was selling. If companies such as Luckin Coffee which are effectively under a microscope compared to other private companies in China are being so brazenly fraudulent it raises a question mark on the wider Chinese economy and how dire the situation might really be across industries and whether much of the so-called Chinese miracle is just a big fraud. Luckin had claimed to be disrupting the coffee industry using artificial intelligence and big data analytics. To add insult to injury Luckin sold 48 million shares of stock in a secondary stock offering in January at 42 a. Chinas Luckin Coffee has agreed to pay a 180 million penalty to settle accounting fraud charges the Securities and Exchange Commission says.

Source: kr-asia.com

Source: kr-asia.com

With defrauding investors by materially misstating the companys revenue expenses and net operating loss in an effort to falsely appear to achieve rapid growth and increased profitability and to meet the companys earnings estimates. However the recent fraud has led to the great attention fear of the reliability and value of Chinese stock market. The Luckin Coffee fraud scandal was a great morality tale for markets and more needs to be done to protect American investors from such cases said an analyst who said a bill to delist Chinese. But within a year of its founding in. Luckin Coffee To Investigate Usd 310 Million Of Fraudulent Sales As Share Price Dives 75 Krasia.

Source: bartalks.net

Source: bartalks.net

Forensic Accounting Acnt620 Luckin Coffee Financial Reporting Investi gation. The Luckin Coffee fraud scandal was a great morality tale for markets and more needs to be done to protect American investors from such cases said an analyst who said a bill to delist Chinese. However the recent fraud has led to the great attention fear of the reliability and value of Chinese stock market. To add insult to injury Luckin sold 48 million shares of stock in a secondary stock offering in January at 42 a. The Story Behind How Luckin S Fraud Was Discovered.

LK Luckin or the Company went public in May 2019 it was a fundamentally broken business that was attempting to instill the culture of drinking coffee into Chinese consumers through cut-throat discounts and free giveaway coffee. Luckin Coffee Financial Reporting Investigation. Forensic Accounting Acnt620 Luckin Coffee Financial Reporting Investi gation. Luckin failed to disclose accurate revenue and expenses and also obtained money through false bank statements. Luckin Downfall Of The Coffee King Blogs Televisory.

Source: forbes.com

Source: forbes.com

AP Chinas Luckin Coffee has agreed to pay a 180 million penalty to settle accounting fraud charges the Securities and Exchange Commission says. Company Profile The first store in Luckin coffee opened in October 2017 and Luckin coffee was listed on NASDAQ on May 17 2019. Chinas Luckin Coffee to pay 180 million fine in fraud case The US. Chinas Luckin Coffee has agreed to pay a 180 million penalty to settle accounting fraud charges the Securities and Exchange Commission says. China S Luckin Coffee Founder Is 1 Billion Poorer After Company Announces Fraud Investigation.

Source: caixinglobal.com

Source: caixinglobal.com

When Luckin Coffee NASDAQ. The class action against Luckin Coffee involves one of the largest cases of securities fraud involving a Chinese company trading on US. In early April China-based Luckin Coffee shocked investors and consumers worldwide when its board revealed in an SEC filing that it has initiated an internal investigation into the activities of its former Chief Operating Officer COO which are. Forensic Accounting Acnt620 Luckin Coffee Financial Reporting Investi gation. China S Market Regulator Piles Penalties On Luckin Coffee Over Fraud Scandal Caixin Global.

Source: cbs42.com

Source: cbs42.com

If companies such as Luckin Coffee which are effectively under a microscope compared to other private companies in China are being so brazenly fraudulent it raises a question mark on the wider Chinese economy and how dire the situation might really be across industries and whether much of the so-called Chinese miracle is just a big fraud. Luckin had claimed to be disrupting the coffee industry using artificial intelligence and big data analytics. Luckins Alleged Fraud Luckin is a coffee retailer founded in 2017 based in Xiamen the Peoples Republic of China. To add insult to injury Luckin sold 48 million shares of stock in a secondary stock offering in January at 42 a. China S Luckin Coffee To Pay 180 Million Fine In Fraud Case Cbs 42.

Source: seekingalpha.com

Source: seekingalpha.com

If companies such as Luckin Coffee which are effectively under a microscope compared to other private companies in China are being so brazenly fraudulent it raises a question mark on the wider Chinese economy and how dire the situation might really be across industries and whether much of the so-called Chinese miracle is just a big fraud. AP Chinas Luckin Coffee has agreed to pay a 180 million penalty to settle accounting fraud charges the Securities and Exchange Commission says. Unfortunately they couldnt tie all the loose ends. In an effort t o beat out their competitors and maintain astonishing performance Luckin. If You Bought Luckin At Recent Highs It S Best To Hold Nasdaq Lk Seeking Alpha.

Market watchdog says Chinas Luckin Coffee has agreed to pay a 180 million penalty to settle accounting fraud charges By ELAINE KURTENBACH AP Business Writer December 16 2020 846 PM 2 min read The Associated Press. These were some of the claims that inspired investors to believe that they could take on a company such as Starbucks on a global scale. The chains coffee brand is just 20 months old ready to be listed on the Nasdaq Stock Exchange in May 2019and raised an additional 113. Luckin Coffee as one of the most successful marketing cases in China or even the world break the fastest IPO record in China in 2019. Atlantis Press Com.

Source: thestreet.com

Source: thestreet.com

Luckin Coffee once a respected profitable company has been caught up in financial statement. In early April China-based Luckin Coffee shocked investors and consumers worldwide when its board revealed in an SEC filing that it has initiated an internal investigation into the activities of its former Chief Operating Officer COO which are. Luckins Alleged Fraud Luckin is a coffee retailer founded in 2017 based in Xiamen the Peoples Republic of China. In an effort t o beat out their competitors and maintain astonishing performance Luckin. Luckin Coffee Accused Of Fraud Key Facts So Far Thestreet.

Source: ft.com

Source: ft.com

Forensic Accounting Acnt620 Luckin Coffee Financial Reporting Investi gation. In 2020 the Securities and Exchange Commission SEC charged Luckin Coffee Inc considered by many to be the Chinese rival to Starbucks with defrauding investors by. Luckin Coffee once a respected profitable company has been caught up in financial statement. Luckin failed to disclose accurate revenue and expenses and also obtained money through false bank statements. Luckin Debacle Shakes Investor Faith In New York S China Listings Financial Times.

Source: pandaily.com

Source: pandaily.com

The chains coffee brand is just 20 months old ready to be listed on the Nasdaq Stock Exchange in May 2019and raised an additional 113. In late January 2020 noted short-seller. Company Profile The first store in Luckin coffee opened in October 2017 and Luckin coffee was listed on NASDAQ on May 17 2019. In early April China-based Luckin Coffee shocked investors and consumers worldwide when its board revealed in an SEC filing that it has initiated an internal investigation into the activities of its former Chief Operating Officer COO which are. Stained By Fraud Scandal Luckin Coffee Is Seeking A Path Out Pandaily.

Source: smartkarma.com

Source: smartkarma.com

Unfortunately they couldnt tie all the loose ends. Luckin coffee so as to infer the impact of financial fraud on Luckin coffees financial risks. The class action against Luckin Coffee involves one of the largest cases of securities fraud involving a Chinese company trading on US. This paper analyzes the fraud of Luckin Coffee faking process and the general publics. Brief Consumer Luckin Coffee Fraud Unfolds And More Smartkarma.

Source: news.cgtn.com

Source: news.cgtn.com

LK Luckin or the Company went public in May 2019 it was a fundamentally broken business that was attempting to instill the culture of drinking coffee into Chinese consumers through cut-throat discounts and free giveaway coffee. Luckins Alleged Fraud Luckin is a coffee retailer founded in 2017 based in Xiamen the Peoples Republic of China. In early April China-based Luckin Coffee shocked investors and consumers worldwide when its board revealed in an SEC filing that it has initiated an internal investigation into the activities of its former Chief Operating Officer COO which are. Market watchdog says Chinas Luckin Coffee has agreed to pay a 180 million penalty to settle accounting fraud charges By ELAINE KURTENBACH AP Business Writer December 16 2020 846 PM 2 min read The Associated Press. Luckin Coffee Shares Plunge From 24 To 5 On Fraud Finding Cgtn.

Source: prezi.com

Source: prezi.com

With defrauding investors by materially misstating the companys revenue expenses and net operating loss in an effort to falsely appear to achieve rapid growth and increased profitability and to meet the companys earnings estimates. These were some of the claims that inspired investors to believe that they could take on a company such as Starbucks on a global scale. In 2020 the Securities and Exchange Commission SEC charged Luckin Coffee Inc considered by many to be the Chinese rival to Starbucks with defrauding investors by. Luckin Coffee Financial Reporting Investigation. Luckin Coffee By Yixuan Li.

Source: kr-asia.com

Source: kr-asia.com

These were some of the claims that inspired investors to believe that they could take on a company such as Starbucks on a global scale. Chinas Luckin Coffee to pay 180 million fine in fraud case The US. AP Chinas Luckin Coffee has agreed to pay a 180 million penalty to settle accounting fraud charges the Securities and Exchange Commission says. Luckin then announced that over USD 300 million in sales transactions in the last three quarters of 2019 were fabricated. Key Stat Nasdaq Delisted Coffee Chain Luckin Gets Its First Fine Krasia.